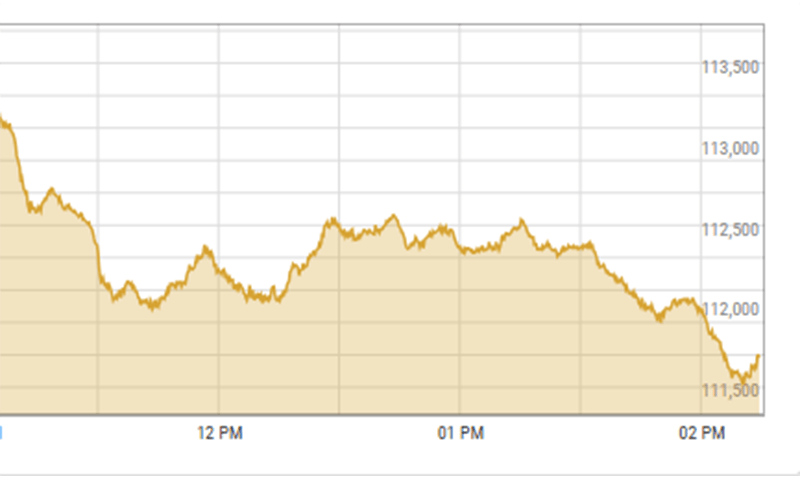

Bears retained their grip on the Pakistan Stock Exchange (PSX) on Tuesday as the share lost about 1,1500 points.

The benchmark KSE-100 index fell 1,489.96 points, or 1.31 percent, which closed at 112,030.36 points near the previous 113,520.32.

“The market started yesterday after a news report in which the Minister of Petroleum said that Rs 82 billion would be used to shield consumers with the profit of government companies,” said Yusuf M. Farooq, director of Chase Securities. “The cost of gas.”

He said that these remarks have raised concerns among market participants that the government can return to use government -owned businesses (SOE) to please the public by echoing past methods. “”

However, he believed that “such action would not be legally possible”.

In addition, Farooq said that after seeing an important rally from October to December last year, the market appears to be “breathing”, adding that such reforms are normal.

“However, the remarks of the Minister of Petroleum have increased the caution of the investors,” he added.

Director Research in AKD Securities, Evas Ashraf, noted that investors are concerned about the Trump administration’s decision to suspend US aid to Pakistan.

Last week, the United States, the world’s largest donor, is practically freezing all foreign aid, which is merely an exception to emergency food, and military financing for Israel and Egypt.

Foreign Secretary Marco Rubio sent an internal memo after President Donald Trump promised “US First” policy to strictly ban aid abroad.

Ashraf highlighted, “However, this problem is not special to Pakistan but spreads to all countries. Part of external funding for the financial year 25”.

He highlighted that the total grant allocated for the financial year 2025 (FY 25) is only $ 176 million, representing the 1pc of the total external funding target of $ 19.34 billion.

“Interestingly, Pakistan received a $ 38.3 million grant from the United States during the first five months of fiscal year,” he added, adding that it exceeded $ 21 million budget for the entire year. What

He added: “Moreover, there is no allocation for bilateral loans from the United States in the financial year 25.”

Meanwhile, Mohammad Sohail, the chief executive of the topline securities, attributed the recession to the January roll over and less expected results, which put pressure on the market.

Yesterday, despite strong expectations for the sixth straight deduction in the financial policy review meeting, stocks mainly witnessed the roller coaster session due to political instability, rise in gas prices and the disappointing results of the corporate. –

The Economic Coordination Committee termed the decision to raise gas prices through about 17 PCs for detained power plants. The move created a strong response from the exporters, especially the textile sector, which said the move would damage the country’s export competition in regional and international markets.

To follow more