Meta has just announced that she plans to spend up to $ 65 billion this year on AI infrastructure.

In the financial world, the term “Magnifant Seven” is a fun manner that is collectively used to refer to the world’s largest artificial intelligence (AI) stock: nvidiaFor, for, for,. appleFor, for, for,. MicrosoftFor, for, for,. AlphabetFor, for, for,. AmazonFor, for, for,. Meta PlatformAnd Tesla.

In this harmony, Meta and Tesla occupy two bottom places as measured by the market cap. Although each of these trillion dollars in stocks have numerous AI tail winds that can increase growth in the long run, I see 2025 as a potentially challenging year for Meta.

I am going to dig the details of a unique scenario of Meta and included Broadcom (Avgo 2.59 %Jes And make the issue of why broadcasters can emerge as a more valuable company by the end of the year.

Meta just made a big announcement

In December, Wedding Technology Research Analyst Dan Ivy published a brief report in 2025, presenting his market forecasts. An item in the list was demanded $ 1 trillion this year only this year’s AI -related infrastructure.

Well, less than a month a month in the New Year, I think Ius can be fine. Over the past few weeks, many Tech Titans have stepped up and made it clear that 2025 is a year, which includes the capital costs of the capital.

Microsoft only offers $ 80 billion infrastructure costs for data centers in 2025. Meanwhile, Openi, OrangeAnd Soft Bank Under President Trump, the newly announced star gate is leading the move. The project aims to invest $ 500 billion in the AI framework in the coming years.

A few days ago, Meta announced that she was joining her megakup tech colleagues, providing her own expenses. According to reports, Meta plans to spend this year in several infrastructure requirements, including chips, data centers and servers.

Image Source: Getty Images.

Why do I think this AI spent will put pressure on the meta in the near future

At the level, you think that the Meta -based affiliation with the AI Roadmap is a good thing. Although I agree with this sentiment, but there is a warning: I think the Meta will become one of the leading AI’s leading businesses in the world under the Meta road … but in the closest, I’m predicting that The $ 65 billion infrastructure project is going. Mark Zuckerberg and his executive leadership team to put some pressure on the team. Why? Because people do not forget the past.

Allow me to explain what I mean. On October 28, 2021, Meta converted her name to Facebook platform. The moment indicated a change in the company’s primary focus sectors – in which social media applications moved to a deep engagement in taking advantage of virtual reality. This concept is known as metawar, and for a hot minute, it can talk about all the investment world.

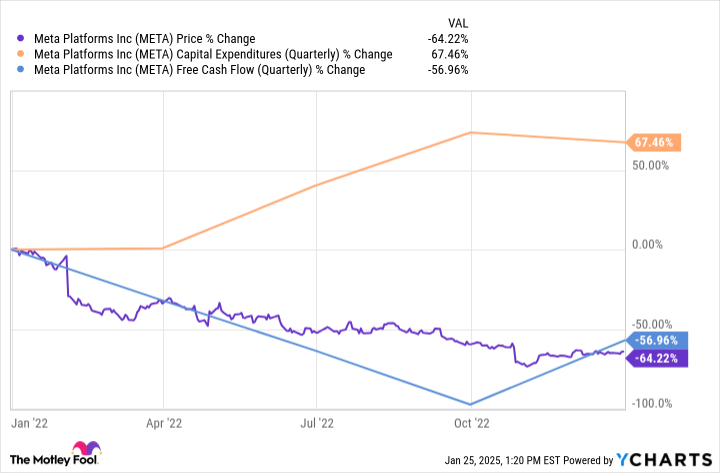

In the chart, I exemplify the percentage of Meta stock prices, free cash flow, and percentage of capital investment by changing its name in October 2021 at the end of 2022. The dynamics shown makes it clear to one thing: the company’s metawar cost is so important that so much so that its profitable profile has become very long. Not surprisingly, investors were not very excited about this upside -down relationship, and meta stock has more than 60 % tank.

Meta’s heavy AI Bill can be music on Broad Work Ears

For most parts, seven companies dominate any rhetoric related to AI. But for the past two years, Broadcoming has quietly become one of the most influential players in AI Arena. The reason for this is that many of the world’s leading AI business relies heavily on the networking and infrastructure solutions of Broadcom.

Broad work offers cloud security, semiconductors, networking equipment and many more products. If you are investing in the infrastructure of the data center, there are difficulties there is a broad work on the way.

According to the notifications of the outside Digites And TickerMeta is considered a major user of specific integrated circuit (ASIC) chips related to the Broadcom Custom Application. To me, Meta’s Capex should spend this year as a balcony for the Broadcom AI business.

Why can Broad work eclipse Meta in 2025

According to this writing, Meta’s $ 1.6 trillion market capitalization is about 14 percent higher than the $ 1.1 trillion value of Broadcom.

Although the 14 % increase in the value of the shares is quite meaningful, I think it is within the scope of the possibility of broadcoming this year. However, in 2024, the company’s shares increased by 108 % – and it was really the first year in which Broadcom started to take advantage of the growing costs of AI infrastructure.

In my view, the moment of broader work has arrived, and as long as the hypersoniclers are committed to the data center bloodout, the company should experience some meaningful tail winds.

I can’t help but think that investors will be focused on meta expenses and cash flu profiles this year, watching a few years ago the metawar defeat. If there are any signs of hiccups about profit, Meta’s stock can start selling in a meaningful way.

In addition, even if the Meta manages to accelerate revenue and income in the light of this heavy capacity budget, it is difficult to know what the growth rate by investors will be considered acceptable, now expectations. There are high and pressure is underway to implement the company.

This year, the growing infrastructure spent the body well for the prospects for growth. Still, surprisingly, these dynamics can represent the definition of the definition of a long -term shares near the meta. For these reasons, I think broad work can become more valuable stock than meta at the end of the year.

Former Market Development Director and Facebook spokesperson and Member of the Metro Platforms CEO Mark Zuckerberg, Randi Zuckerberg, is a member of the Board of Directors of Motley Fool. John Mikey, a former CEO of the Amazon, is a member of the Board of Directors of Motley Fool. Suzanne Free, Alphabet Executive, is a member of the Board of Directors of Motley Fool. Adam Spatako’s alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla are positioned. Motley Fol has the position of alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla and recommended. Motley Fool recommends broadcast work and recommends the following options: Long Jan 2026 $ 395 calls on Microsoft and short Jan 2026 $ 405 Microsoft calls. Motley Fool has a diagnosis policy.