Popular opinion is not always correct.

In January, an average retired worker beneficiary brought the house to 9,1,976 checks from Social Security. Although this average monthly payment may not seem high, in 2022, Social Security helped 22.7 million people get out of poverty, including 16.5 million adults aged 65 years and older.

Despite the uncertainty of social protection sports uncertainty in helping the elderly Americans end, the basis for this well -known program of retirement has been falling for decades. Although a combination of factors is responsible for the deteriorating financial approach to social security, the accusation finger often refers to Congress.

Image Source: Getty Images.

Social Security is competing with a lack of long -term funding over $ 23 trillion

In January 1940, the Social Security Administration (SSA) sent its first retired worker Benefift Check. Since this point, the Social Security Board of Trustee has released an annual report that details the program’s financial health. It also includes a keen eye on income and costs for social security every year, as well as predicting the future solvence of the US -leading retirement program.

In each of the last 40 reports, the trustees have warned of lack of long -term funding responsibility. In other words, the trustees have predicted the gross revenue received in 75 years after the release of a report and determined that, including cost adjustment (COLAS), out -of -lease easily ahead Will increase.

According to the 2024 Trustees report, the long -term cash reduction of social security is estimated at $ 2098 to $ 23.2 trillion. It has increased by $ 800 billion due to the lack of responsibility for the 75 -year -old funding in the 2023 trustee report.

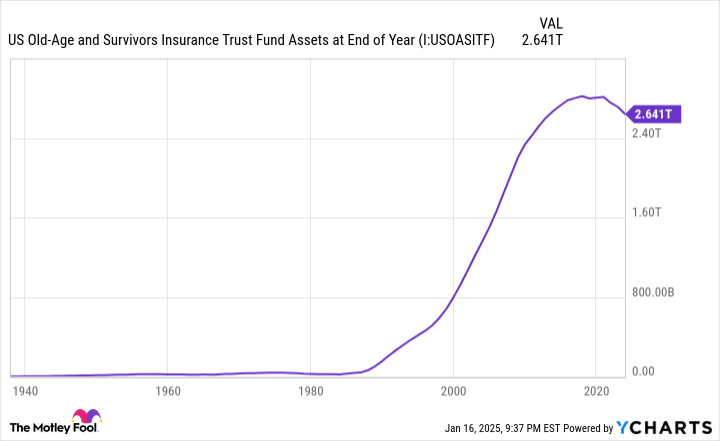

In addition, the trustees have called for the expected reduction of assets of the old age and surviving insurance Trust Fund (OASI) by 2033. Although retired workers and dead workers survived are not at risk of going bankrupt funds. Or after becoming incredible, the fatigue of OASI’s assets in eight years will result in an expected decrease of 21 % in monthly payment.

The question of the million dollars is: “Who is responsible for the deteriorating financial situation of social security?”

OASI’s assets reserves are predicted to end in 2033. At the end of the year, the US Old Age and the surviving insurance trust fund assets Via data ycharts.

Did lawmakers really stole from social security trust funds in Congress?

If you want to use the social media message board on social security topics/subjects, you generally know that Congress is a goat of sacrifice. Specifically, some commentators indicate the idea of lawmakers that social security trust funds are stealing or raiding the funds to fund wars and other lines, and “in return with interest Have failed. “

The thing about popular opinion about social security is that what is popular is not always right that is right. In this example, the idea of Congress’s theft of trillions of social protection is completely baseless.

In August 1935, President Franklin de Roosevelt signed the Social Security Act in the law. In the list of the provisions and rules laundry list by the 1935 Social Security Act, the treatment of any additional income (assets reserves) collected – ie, which has been paid in benefits and more collected. Used to meet the SSA management. Cost to run the program.

According to the law, any additional income collected by social security is to be spent on special issues, government bonds related to interest. US Treasury Bonds are extraordinarily safe and support the US government’s full faith.

Most importantly, each of these special issues is the calculation of each percent of the bonds. In fact, the SSA updates the Joint Asset Reserve amount for the OASI and Disability Insurance Trust Fund (DI) every month, along with the average interest rate generated on its assets reserves. By the end of December 2024, Joint OASI and DI had about $ 2.721 trillion in assets reserves, with an average production of 2.557 %.

The idea that the Congress has “stolen” the money is a misconception of how a deposit (CD) certificate works in the bank. If you buy a $ 10,000 CD in your local bank which is getting 4 %, your bank will not allow your cash to set up your cash in the vault and collect it. Rather, this amount is going to work through loans to produce more than 4 % of the production. Your money has not been stolen by the bank. It still has a complete calculation, and when the time comes, the bank can improve your interest payments and principal.

Similarly, the federal government will not allow 72 2.721 trillion more cash to sit and lose inflation. This cash is applied in government bonds (as needed by the law), which creates a very important interest for social security. If the program is no longer allowed to buy US Treasury, it will lose one of its three sources of income, which will reduce the speeding of rapidly.

Image Source: Getty Images.

Social Security is on the released population shifts behind financial problems

The answer is as clear as the day that the Congress did not steal from the social security trust funds. If you want to know what is really behind the financial problems of the program, don’t see a variety of ongoing population shifts.

Some of these ongoing changes that you are probably familiar with and have been listening for years. For example, the Labor Force is reducing the proportion of the Baby Boomers retirement labor.

Similarly, we have been living longer than a long time when a retired social security worker check was first sent in 1940. The program was not designed to eliminate retiring benefits for decades.

But there are other Latif settlement shifts that have a huge impact on social protection. For example, pure legal relocation in the United States increased by 58 % from 1998 to 2023. In the United States, immigrants are underage, which means they will contribute to the labor force for decades in contributions through salary tax, which is the basic social security fund. Mechanisms briefly. , One of the biggest problems is that enough legal immigrants are not coming to the United States

The American birth rate is also low. Although the underage rate does not immediately hurt social protection, the proportion of the workers is being pressured after another 10 to 20 years now when the new workers have enough to meet the appropriate beneficiaries Workers are not entering power.

The second problem is the increase in income inequality. In 2025, all income (wages and salary, but not investment income) is subject to 12.4 % payroll tax between 1 0.01 and 6 176,100. About 94 % of all workers will earn less than 176,100, and thus they will earn every dollar in social security.

On the other hand, about 6 6 % of workers earn north of $ 176,100 and will be exempt from payroll tax more than this figure. Over time, a high percentage of earned income is “escaping” tax tax.

Legislators are responsible for not raising their heads soon to strengthen social protection. But there is no definite evidence that the Congress has stolen from the US -leading retirement program.