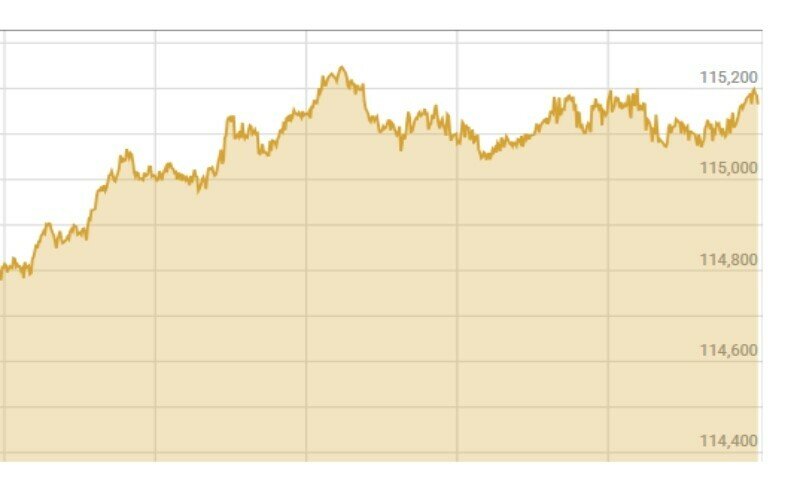

On Thursday, the bills regained control of the Pakistan Stock Exchange (PSX) as the shares scored more than a thousand points.

The benchmark KSE-100 Index stood at 115,094.23 points of 114,084.53 to gain 1,009.70 points, or 0.89 percent.

Investors were happy among the expectations that the International Monetary Fund (IMF) review would “be easily approved with the old circular loan issue to solve the support of banks,” said Mohammad Sohil, the chief executive of the top line securities.

Sana Tofak, the head of the research at Arif Habib Limited, called the speed of the speed to transform Moody’s country’s banking perspective into positive.

The global ranking agency Moody has upgraded Pakistan’s banking perspective in positively at the back of better financial performance.

“We have made our viewpoint positively positive about Pakistan’s banking system to reflect the flexible financial performance of the banks, as well as improve economic economic conditions from a very weak level a year ago,” said the rating agency.

Financial sector experts say that banks have made considerable profit in the last two years, despite lack of lack of engagement in using their money for economic growth. Borrowing to the private sector has been disappointing. However, in the fiscal year 24, 22 % and even more government’s aggressive loans have enriched banks.

In the second news, Tufak also supported the upward pace to circulate the news in connection with the ongoing negotiations with the IMF on the circular loan.

Yesterday, the stock market faced sales pressure, which led to the announcement of an increase in gas tariffs for the captive power plants (CPPS) due to concerns about the economic outlook of the benchmark index, which was indicated by the IMF mission.

The government had informed the 23 PC hike in gas prices for CPPs, which would undoubtedly pursue production costs and damage the export sector, especially the textile sector.