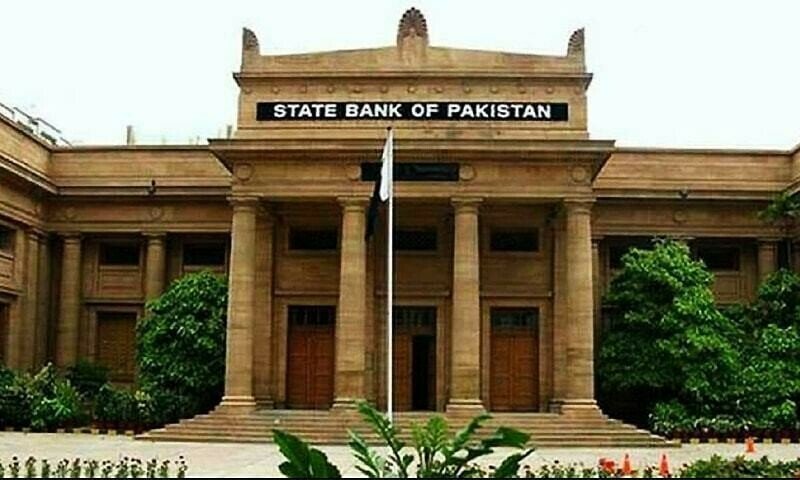

The State Bank of Pakistan (SBP) announced on Monday that it had decided to change the current real interest rate by 12 % to maintain the ongoing economic stability, and the current real interest rate has been estimated.

The Central Bank’s policy rate, after a decrease of 1,000bps from 22 pcs in six intervals from June 2024, is now 12pc.

In February, the inflation was standing at the lowest level of 1.5pc in the nearest decade, the main reason for a year ago. A Reuters A survey of 14 analysts suggests that the central bank can further reduce the rates with an average forecast for a 50 BPS kit. Of the 10 analysts expecting the rate to be cut off, three on the size of 100 BPS, a 75 BPS, and six 50 BPS. There was no change in the rest.

According to a notification issued by the State Bank of Pakistan, the Monetary Policy Committee decided to convert the policy rate to 12pc, noting that inflation proved less than expected in February, the main reason for food and energy prices.

The notification states, “Despite this fall, the committee estimated the dangers posed by the hereditary fluctuations in these prices, which has reduced the current decline in inflation.”

It states that basic inflation is proving more permanent at a high level, thus, increasing food and energy prices can increase inflation.

“Economic activity continues, as the economic indicators of the latest high frequency appear,” he said, adding that the MPC saw that the increasing imports between weak financial arrivals have led to some pressure on the external account.

“MPC has evaluated the current real interest rate to be properly positive [the] The basis for a look at the ongoing economic stability, “is stated in the notification.

According to the notification, the committee noted that the current account has turned into a loss of $ 0.4 billion in January in January after being extra in the past few months.

It states that the current account deficit, combined with weak financial arrival and debt payments, led to a reduction in SBP’s foreign exchange reserves.

It states that despite a significant increase in 19.1PC in December 2024, large -scale manufacturing outputs have decreased during the first half of the fiscal year 2025.

The notification states that “the reduction in tax revenue from the target increased in January and February.”

“Both consumers and business emotions have improved during the latest waves,” he said, adding that uncertainty has increased significantly during the ongoing tariff increase, which can have the implications of global economic growth, trade and commodity prices.

“In response to these developments, in modern and emerging economies, central banks have recently reduced their financial relaxation,” he said.

“Based on these developments, the committee noted that the effects of widespread decline in policy rates are now coming into effect,” he said.

The MPC reiterated the importance of maintaining a careful monetary policy position to stabilize inflation in the target of five to seven percent, adding that with structural reforms, sustainable economic growth was necessary.

Due to the potential increase in inflation, most analysts believe that the central bank will stop when the rates rise from 10.5pc to 11pc. They expect a moderate increase from March to May.

Ahmad Mobin, a senior economist at S&P Global, said that the average inflation of 6.1pc for 2025, said that inflation will be “down” in the first quarter of the year gradually.

Despite the “sharp drop” in the Consumer Price Index (CPI), he said that urban basic inflation, which indicates prices pressure, was higher at 7.8pc.

In its last policy meeting, the central bank maintained the GDP growth all year to 2.5pC at 3.5pC, and predicted that rapid growth would help promote foreign exchange reserves, which were extraordinary.

“While GDP has gained 0.9 pc growth in the first quarter of the financial year 2025, large -scale manufacturing is left in the negative area, and its production is not yet accelerated.”

“Low rates in economic activity are yet to be transferred.”

He added that this goal was possible only when industrial activity was raised and agricultural production improved.