Bills took the trade destination in the Pakistan Stock Exchange (PSX) when the shares climbed more than a thousand points on Monday after a one -week permanent institutional sale.

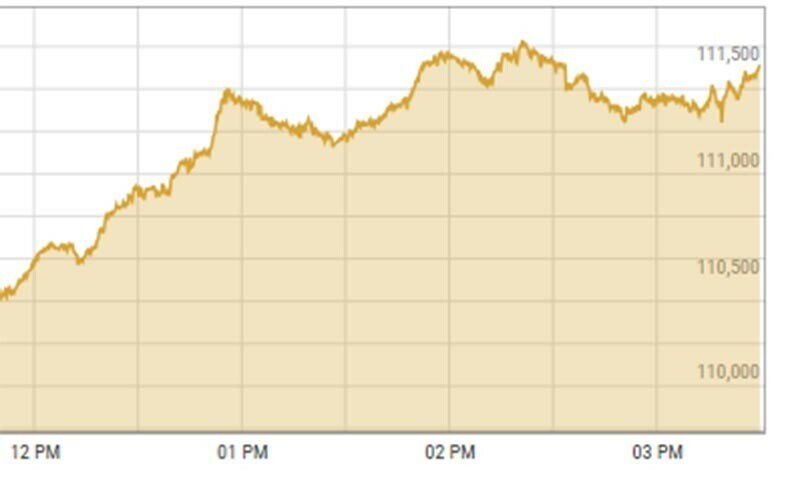

The benchmark KSE-100 Index increased by 1055.03 points, or 0.96 percent to stand at 111,377.96 points, from the previous close of 110,322.93.

Talking to Topline Securities Chief Executive, Mohammad Sohail, Don Dot Com Attributed the speed of “better results of the market helping the market.”

He added that “the first IPO of 2025” also indicates the market’s positive emotions.

According to a press release, Zaria Limited is “going to the public”, which collected Rs 1 billion through his initial public offer (IPO).

Last week, the stock market was under pressure for the third consecutive week on permanent institutional sales, with significant reduction in tax revenue against tax revenue and new delays over delay in loan roll overs due to new concerns over sales. Was done.

Prior to the International Monetary Fund (IMF) review later this month, these issues are particularly worrisome, making investors anxious without any positive progress.

However, the government has hoped for a successful IMF review, which will release the second train under a 37 -month extended fund, which to fulfill the country’s external debt payments. Very important.

On the economic front, the headline for January fell to the lowest level of 101 months, with 2.4pc in the year. In January, the trade deficit increased from 18pc to $ 2.3 billion. Petroleum sales remained stable at 1.38m tonnes in January, with 8 pc monthly growth. In the first month of 2025, the number of cement sending increased from 14PC to 3.89m tonnes. Meanwhile, sales of urea and DAP decreased by 27pc and 6pc, respectively.

SBP reserves increased by $ 46 million.