A large -scale medical bill was cleared after you reached Wral 5 by a Wake County woman.

Vendel’s Melissa coach has a chronic joint disorder that makes it difficult to take care of and take care of his three young children.

The coach explained to you 5, “All my joints are affected by it.” “None of my joints really have no cartilage, and the little cartilage is worn over time, which requires joint changes.”

In order to improve your movement and relieve pain, the coach went to Duke University Hospital in October 2024 for a transformation of his second ankle. Before the surgery, he received permission from his insurance company, North Carolina’s Blue Cross and the Blue Shield, and was not expected to pay anything out of his pocket.

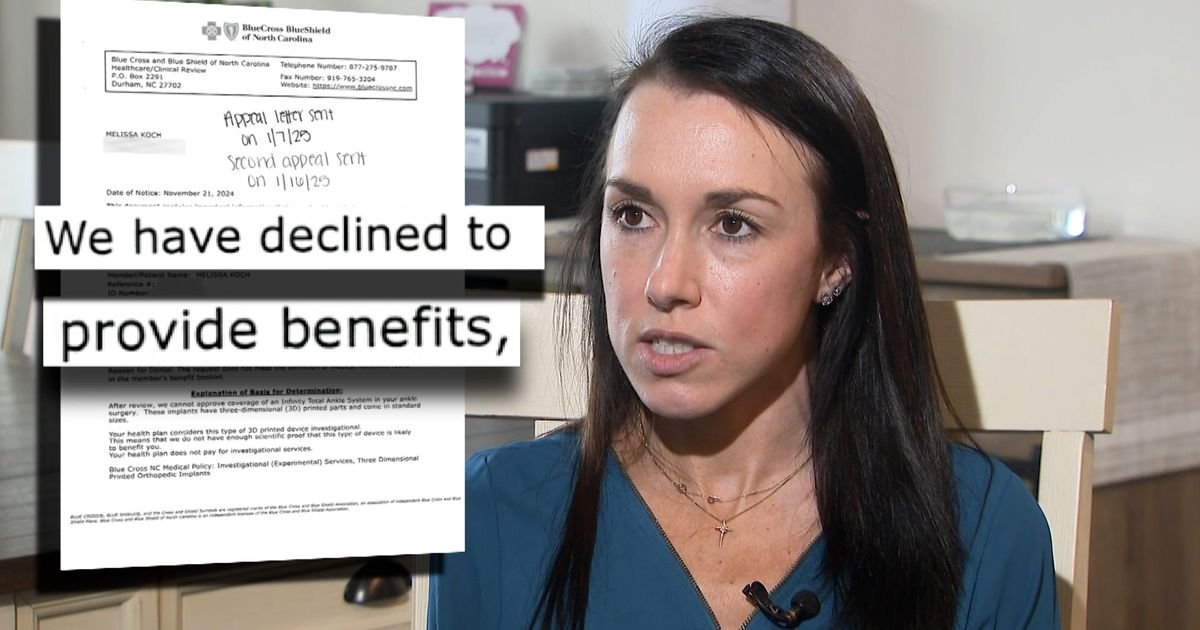

“We thought it was completely covered. On October 24, through surgery, it is completely fine. The coach said, “About a month later, on November 21, I received a letter in the mail stating, ‘Sorry, we have decided to refuse the surgery.”

The coach appealed for the decision but was denied again.

“The services were denied as an investigation,” the denial said. The claim amount on refusal was 6 126,035.12

On your behalf, Wral 5 asked if there was a moment where the coach thought he would have to pay the money.

“Yes, [after] Second refusal, because most times after that, I didn’t think they would consider me something else. So I called Wral, “the coach said.

Wral 5 on your behalf reviewed the coach’s records. The denial explained that the implant of artificial ankle was printed 3D, and was considered experimental because the BCBSNC has “does not have such scientific evidence that this type of device is likely to benefit” coach’s standard of living.

The BCBSNC came to the conclusion, yet the coach had the same implant, in the same hospital, with the same doctor, four years ago, a similar procedure and said it was successful.

Our team arrived at the Duke University Hospital and Blue Cross and Blue Shield in North Carolina, told them they look at the coach’s case and what was appropriate.

A few weeks later, the coach received a letter from the BCBSNC in the mail stating that the denial of the claim of 6 126,035.12 was being abolished.

The coach said, “Finally there was such a relief, ‘Well, we are not in debt of $ 126,000.”

North Carolina’s Blue Cross and the Blue Shield immediately of this statement. Sent to you after 5: its immediately. After:

“North Carolina’s Blue Cross and the Blue Shield are grateful for the opportunity to serve as Mrs. Coach’s insurance plan and allow us to provide us with the opportunity to resolve the issue. We agree that it should not have been, and we apologized for this. Must not have been responsible for any expenses. “

Duke University Health System CFO Lisa Goodlet told us that 3D printed model was used while coach’s care, but it was not part of the artificial product.

“The Duke had developed a model, a 3D model, to ensure that the implant would work as expected. It was never put into the patient, but somehow there was an idea that we had 3D content in the patient, which we did not have.

During our interview, Goodlet said that health insurance denial has become an “extraordinary problem” throughout the board.

“We have a team of more than 150 people who only deal with refusal to make different payers,” said Goodlet. “98 % of the time when we are denied, through this extra work we are able to overthrow it. So, why do we go through this 98 %? Why don’t we just pay the patient, take care of it for the first time?

A Recent studies Through the KFF-a non-profit Foundation that focuses on health policy research, polling and journalism-considered claims of 2023 to 392 million networks, and found that insurance companies have denied 19 % of those claims.

Consumers appealed for less than 1 % of denial. When the refusal was appealed, the insurance companies retained 56 % of these refusal.

However, this is not the whole picture. Most insurance denying data is not common, so we know that we know any context.

The coaches are hoping that by sharing what is going on, others will be affected to fight these health insurance.

“I knew it was wrong. If they know this, or if they think they are wrong, they can use their voice.

After the solution

Health insurance and billing may be confused, so you continue to talk after you have eliminated the refusal of coach’s coverage with Duke University Hospital and North Carolina’s Blue Cross and Blue Shield.

During the talks, the BCBSNC said the letter coach was $ 126,035.12, refusing his appeal and note the claim amount, it was not the bill. A spokesman explained that the letter did not ask for payment. However, the letter did not even say who was responsible for the claim money.

He also said that the responsibility of the member described on the explanation of the benefits should agree with any bill that the member receives from his provider. If the benefits and providers do not align the bill, members should call on their health insurance plan.

The spokesman added that this situation was a misunderstanding.

The insurance company also said: “We understand that coverage of health care and health insurance is often more complicated than that, and we are working to make our members easier to get the care of our needs.”

![Chromecast (2nd gen) and Audio cannot Cast in 'Untrusted' outage [Update]](https://newsplusglobe.com/wp-content/uploads/2025/03/1741746771_Chromecast-2nd-gen-and-Audio-cannot-Cast-in-Untrusted-outage-150x150.jpg)